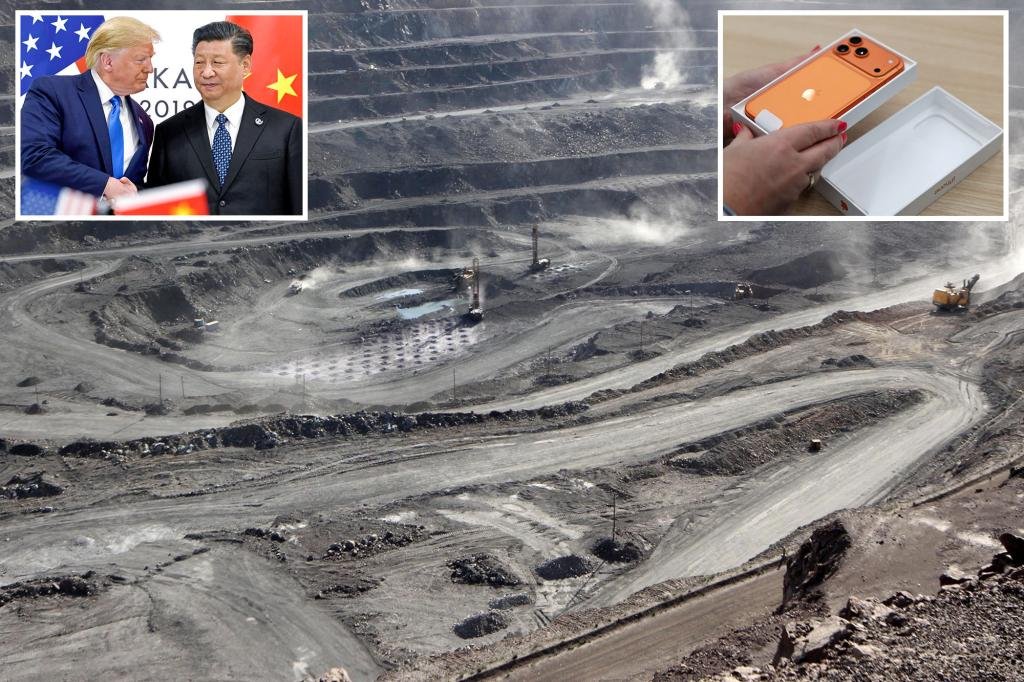

How China’s threats to clamp down on rare earth exports could hurt US tech giants and military contractors

China pledged to do so Throttle of rare earth element shipments It could hurt tech giants like Apple and Tesla as well as major US military contractors, and experts have described it as a key bargaining chip as Beijing bargains with President Trump over tariffs.

American companies and investors alike are scrambling to assess the impact of Beijing’s announcement that foreign entities must obtain special licenses starting Dec. 1 to export products containing more than 0.1% rare earth metals and magnets originating in China.

Stocks rose on Monday After Trump said relations with China would be “good” despite the recent dispute. The rebound occurred after Trump announced 100% retaliatory tariffs on Chinese goods effective November 1, leading to the largest single-day selloff in six months last Friday.

Shares of US-based rare earth miners USA Rare Earth, Critical Metals and MP Materials rose 20% or more on Monday.

China will have “significant discretion to delay, deny or impose conditions” on exports involving advanced technology, according to Gracelyn Bhaskaran, director of the Critical Minerals Security Program at the Center for Strategic and International Studies. Critical minerals are needed to make iPhones, electric cars, drone engines, F-35 fighter jets and Tomahawk missiles.

“The move enhances Beijing’s influence in the upcoming talks while also undermining US efforts to bolster its industrial base,” Bhaskaran said in a blog post.

It is unclear how China plans to implement the rules, as US companies seek to understand how to obtain export licenses and comply with its strict requirements. Experts have warned for months that hiccups in the supply chain will occur It leads to higher prices for Americans buying tech gadgets.

The Chinese Ministry of Commerce said that any license applications for products with military uses would likely be rejected. Licenses related to AI products and chip production will be reviewed on a case-by-case basis.

Mark A. said: Smith, CEO of Nebraska-based rare earths miner Newcorp, said he doubts Beijing will give up its strategic influence even if trade talks go well.

“I don’t see China negotiating the elimination of the dual-use export control regime it has in place for heavy rare earth elements,” Smith told The Washington Post. “They will say nice things about not having a ban on rare earth exports, and they will appear to be tolerant.

“But the PLA will almost certainly ensure that export licenses that could allow (rare earths) to make their way into defense technologies never see the light of day,” Smith said.

China controls about 70% of the world’s rare earth mining and about 90% of processing capacity, and has been steadily cutting off access in recent years amid rising tensions with the West.

In April, China disrupted global shipments and left Western companies scrambling after it suddenly announced a separate set of licensing requirements for rare earth magnets.

Meanwhile, the United States has restricted sales of advanced computer chips, such as those sold by Nvidia, due to national security concerns.

As the Washington Post reported, many experts fear that China may implement a full embargo if diplomatic tensions take a more serious turn — as in the case of an invasion of Taiwan.

Aside from the shipping restrictions, China said it would limit exports of technologies related to mining, smelting, recycling and magnet making — making it difficult for the United States and other countries to increase domestic production.

The rules were announced just weeks before Trump and Chinese President Xi Jinping met on the sidelines of the Asia-Pacific Economic Cooperation Forum in South Korea. Trump threatened to cancel this meeting.

“China’s latest round of tightening export rules underscores what manufacturers have known for a long time: The United States must increase and fortify its critical domestic supply of minerals,” said Michael Duffin, director of energy and resources policy at the National Association of Manufacturers.

Post Comment